Unveiling the Truth Behind Property Investments: A Data-Driven Approach

By Fisco Pro Team

8 mins read

Introduction

Real estate investments often come with assumptions about returns and value. Many investors believe they understand their returns, but the real test comes only when a property is sold currently. For precise decision making, our property analysis calculator is designed to empower financial advisors to make informed decisions.

Real Problems in Property Investment

Misconception About Returns:

Investors often feel good about returns based on assumptions rather than reality. The true value of a property isn't realized until it's sold, highlighting a disconnect between perceived and actual financial gains. Also investors often assume their property value appreciates significantly over time. While an 8% annual growth may appear lucrative, they often neglect key factors:

- Loan Costs: Interest payments can erode perceived gains.

- Maintenance Expenses: Regular upkeep costs are frequently overlooked.

- Capital Investment: The actual invested capital is often forgotten in calculations.

Realizing True Value

The real value of a property is only understood when it is sold. Predicting the exact value requires analyzing factors like:

- Growth rates over the hold period.

- Net returns after all costs.

- Local market trends.

The Illusion of Value:

What's the real value of a property? Only through accurate data analysis can we predict this with any certainty. Holding a property for 10 years might double its value at an 8% growth rate, but without considering all variables, the real benefits remain unclear.

Practical Example

Consider an investor holding a property for 10 years:

- Purchase Price: ₹10 lakh

- Growth Rate: 8% annually

- Target Selling Price: ₹30 lakh

While this seems like a profitable investment, when factoring in loan interest, maintenance costs, and market fluctuations, the actual returns may differ significantly. Using the calculator, investors can:

- Identify if the 15% growth rate is achievable.

- Evaluate if holding longer offers better returns.

Key Scenarios for Decision-Making

Buy Decision

When deciding to buy, investors should not just consider the purchase price but also the total cost of investment, including loans, maintenance, and potential holding costs. Our calculator helps in understanding these aspects, ensuring you're not just buying into a property but into a well-informed investment strategy.

Sell Decision

Deciding to sell involves understanding the precise market conditions, which can be elusive when selling "whenever you want." Our tool allows you to assess if after 5 years, selling would yield the expected return or if holding might offer a better market opportunity.

Hold Decision

Holding a property increases decision-making power, but only if you consider all aspects like maintenance costs, loan interests, and market trends. Our calculator provides insights into whether holding will be beneficial over time, considering both financial growth and market dynamics.

Rental Income Considerations

If the property is rented, the calculator can forecast potential rental income against costs, helping determine if rental is a viable strategy or if selling might be more profitable.

Loan Impact on Selling

Taking a loan changes the equation significantly. Our tool helps decide if selling would be advantageous to offset loan repayments or if continuing to hold could lead to better financial outcomes.

Maintenance Decisions

Often overlooked, maintenance can eat into returns. Our calculator evaluates if the maintenance costs are justified against the property's appreciation and income potential.

Decision-Making Power

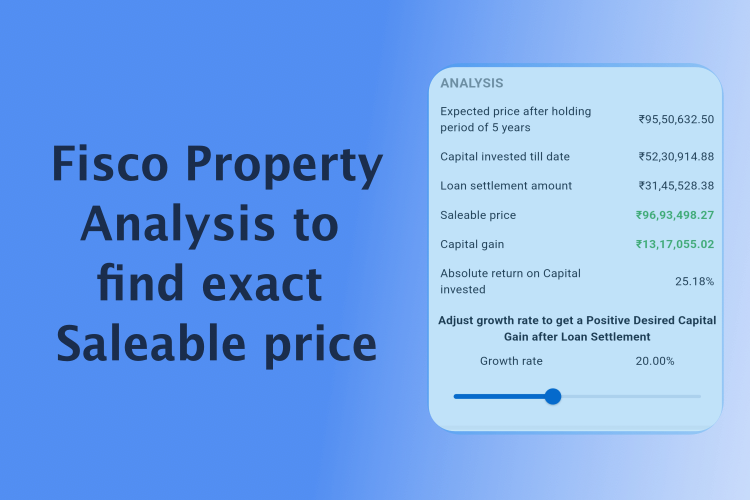

With our property analysis tool, real estate brokers can predict the exact value of a property, aiding clients in making informed decisions about buying, selling, or holding.

Client's Loan Status

Whether a client has taken a loan or not affects the strategy. If no loan exists, finishing the investment journey can be easier, but our tool still helps in optimizing returns.

Minimum Expected Years to Sell

To achieve certain returns, how long must one hold? Our calculator determines the minimum expected years one should consider holding a property before selling.

Minimum Expected Return

What's the least return one should accept before selling? Our tool sets benchmarks for this, helping to avoid selling at a loss or below potential value.

Expected Growth Rate

Assuming an 8% growth rate, if you buy a property for 10 lakh, expecting to sell it for 30 lakh in 10 years, our calculator can validate if this expectation aligns with market trends.

For Certified Financial Planners (CFPs)

Currently, CFPs might lack sophisticated tools for property analysis. Our calculator helps:

- Cost of Investment and Hold Period: Provides clarity on capital outlay versus holding benefits.

- Area-Wise Identification: Helps in understanding local market dynamics versus making assumptions.

How the Calculator Empowers Users

Comprehensive Financial Planning

- Calculates net worth after factoring in all costs.

- Provides accurate growth projections based on assumptions and area-specific data.

Informed Decision-Making

- Enables real estate brokers to guide clients with precise value predictions.

- Helps investors decide whether to buy, sell, or hold based on real data.

Summary

Our property analysis calculator isn't just about numbers; it's about providing a reality check in the world of real estate investment. It empowers investors and advisors alike to make decisions based on data, not just hope or market hype. Whether you're considering buying, selling, or holding, let our tool guide you to decisions that reflect the true potential and pitfalls of property investment.